About rates

Your rates help Council maintain, improve and provide services and facilities for the ratepayers, residents and visitors of our beautiful and unique location and are calculated on a variety of things including where you live.

You can find out more below.

I need to change my postal address

When are rates due?

1st installment: 31 August

2nd installment: 30 November

3rd installment: 28 February

4th installment: 31 May

You can find out more about ways to pay your rates here.

How can I receive my rates notice electronically?

You can receive your rates notice via email by signing up to eNotices.

An eNotices account will give you the ability to:

- Have one account for all your properties.

- Re-print or download extra copies of your notices.

- View all historical notices.

Click here to learn how to sign up to eNotices.

Pensioner concessions

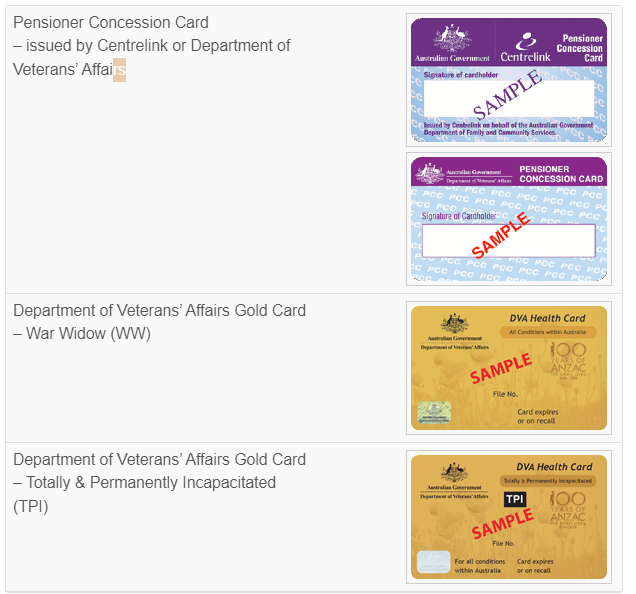

If you have a Pensioner Concession Card or a Department of Veterans Affairs Card you may be eligible for a concession on your rates. Samples provided below show accepted cards for the pensioner concession. Please note that New South Wales does not grant concessions on Health Care cards.

The Pension Concession is available only on your primary residence and your pension card must reflect this address.

Eligible pensioners are entitled to the following rebates:

- up to $250 on all ordinary rates and charges for domestic waste management services

- up to $87.50 on water rates or charges

- up to $87.50 on sewerage rates or charges

The above amounts are fixed by the NSW Government and do not increase with inflation or in line with rate increases.

Please complete a Pensioner Concession form and bring to the Barham, Moama, Moulamein Business Centre or the Mathoura Visitor and Business Centre along with your concession card to apply.

Important Information

If you receive a pensioner concession card after the commencement of a rating year (1 July) and you meet the above conditions, you can claim a rebate from the issue date on the card. Council will only back-date pensioner concession claims to the 1 July of the current rating year.

If you no longer qualify as an eligible pensioner, you will not be entitled to receive a rebate for the rating year in which you ceased to be eligible. Therefore, if you were granted a pensioner rebate in advance that you are no longer entitled to, it will be charged back to your rate account for the period relating to your ineligibility.

Please contact Council's Revenue Section on 1300 087 004 immediately if your eligibility changes.

How do we calculate rates and charges?

Each council is required to determine the combination of rates, charges, fees and pricing policies needed to fund the services it provides to the community by producing a Revenue Policy which contains a rating structure. This rating structure determines which rates and charges you will have to pay and how they will be calculated.

You can view our Revenue Policy here.

The total amount of income that Council can raise from certain rates and charges is limited. This is called rate peg percentage. The Independent Pricing and Regulatory Tribunal (IPART) determines the annual rate peg percentage.

Land valuations

Rates are calculated on the value of your land which is determined by the Property NSW Valuation Services on behalf of the NSW Valuer General. If you do not agree with the land value of your property you can request a review by the Valuer General.

In Murray River Council, land revaluations occur every three years.

Ratepayers will receive Notice of Valuation from the Valuer General with their updated land valuations. Council uses the updated valuations to calculate the rates from July 1 of the next financial year.

To find out more about the Valuer General, the land valuations process, how to lodge an objection and other information, click here.

FACT SHEET: Your Land Value

OBJECTION PROCESS GUIDE: Valuer General Review Guide(PDF, 582KB)

Have your say on Council's Revenue Policy

Each year Council prepares a draft management policy known as the Revenue Policy around May for the following financial year and places it on public exhibition for comment.

Council must consider any submissions by the public before adopting the plan. This is your opportunity to raise any issues about the rates and charges for the following year.

Keep an eye on our Your Say platform for your chance to have your say during May each year.